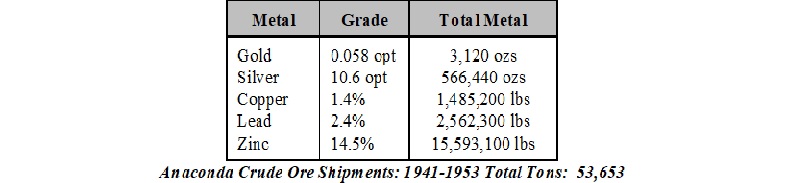

According to historical smelter records maintained by Anaconda, approximately 53,642 tons of mineralized material has been mined to date. These records also indicate average grades of 14.5% Zn, 363.42 g/t Ag, 1.98 g/t Au, 2.4% Pb, and 1.4% Cu were realized.

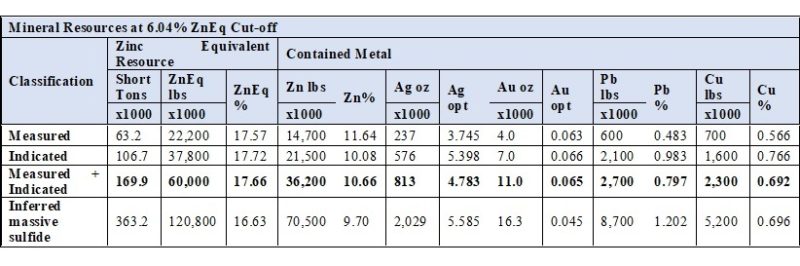

Thunder Mountain Gold Inc. purchased and advanced the Project from 2007 through 2019 investing approximately US$12M during that period. The current mineral resource estimate of the deposit is detailed in Table 3 below and the Company expects to provide a revised mineral resource update following a phase 2 drilling program in 2020.

The Project is largely on and surrounded by private surface land, and as such, the permitting and environmental aspects of the Project are expected to be straightforward. Permits are in place for underground exploration activities and BeMetals does not anticipate significant barriers to any future development at the Project.

The South Mountain Project is considered an advanced stage, high-grade zinc-silver-gold exploration or pre-development project. The land package at South Mountain consists of a total of 17 patented mining claims encompassing approximately 326 acres, 21 unpatented mining lode claims covering approximately 290 acres, and approximately 489 acres of leased private land. In addition, the project owns 360 acres of private land (mill site) not contiguous with the mining claims. All holdings are located in the South Mountain Mining District, Owyhee County, Idaho.

The property is located approximately 70 air miles southwest of Boise, Idaho and approximately 24 miles southeast of Jordan Valley, Oregon. It is accessible by highway 95 driving south from the Boise area to Jordan Valley Oregon, then by traveling southeast approximately 22 miles back into Idaho, via Owyhee County road that is dirt and improved to within 4 miles of historic mine site. The last 4 miles up the South Mountain Mine road are unimproved dirt road. The property is accessible year-round to within 4 miles of the property, where the property is accessible from May thru October without plowing snow. There is power distribution within 4 miles of the site as well. The climate is considered high desert. The Company has water rights on the property, and there is a potable spring on the property that once supplied water to the main camp.

On February 27, 2019, the Company entered into an Option Agreement, (the “BeMetals Option Agreement”) with BeMetals Corp. Under the terms of the BeMetals Option Agreement, BMET USA will be entitled to purchase 100% of the issued and outstanding shares of South Mountain Mines, Inc. (“SMMI”) from Thunder Mountain Resources, Inc. (“TMRI”), both wholly owned subsidiaries of the Company. The term of the agreement is for two years with BeMetals completing a preliminary economic assessment (“PEA”) completed by a mutually agreed third-party engineering firm. Over its term, this agreement requires cash payments to the Company of $1,350,000; $1,100,000 in cash and $250,000 in exchange for shares of the Company’s common stock. Through September 30, 2019, cash proceeds of $100,000 and $250,000 in exchange for shares of the Company’s common stock have been received. In the event that BeMetals decides not to proceed with the South Mountain Project, BeMetals will not be obligated to make any additional payments.

Under the Option Agreement, BeMetals commenced drilling at South Mountain During the third quarter of 2019. BMET plans to drill approximately 20 holes for some 8,000 feet (2,500 meters) from five underground drilling platform locations within the Sonneman level. The drilling program is designed to test potential down plunge extensions, and overall continuity to the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource. Exploration and delineation of the Texas Zone will also be a focus, where the potential exists for an increased copper component to the mineralization based upon historical mining records. This program is the start of providing a first phase of new drilling data towards the completion of a preliminary economic assessment study in 2020.

South Mountain 2019 Highlights:

- High-grade zinc-silver-gold-copper-lead mineralization was extended in the DMEA 1-2-3 sulfide zones by approximately 500 feet (150 meters) down-plunge of previous (2014) mineralized intercepts.

- Initial estimates of high-grade mineralization extend from the Laxey Level to 900 feet down-dip of the Sonneman Level for a total length of over 1,250 feet.

- The massive sulfide bodies are confirmed to be steeply plunging chimneys localized by the intersection of northeast-striking fractures and a receptive pure marble unit that can be traced on the surface for approximately two miles.

- Drill results in 2019 exceeded BeMetals Corporation’s expectations. BeMetals expert consultant Dr. Richard Sillitoe believes South Mountain is a classic carbonate replacement deposit (CRD), with possibly more upside than originally anticipated.

- The 2019 Phase 1 drilling program completed according to schedule and under budget.

- The Phase 2 drilling on is scheduled to commence in early 2020.

The 2019 drilling campaign was designed to test the down-dip extensions of the zones, and confirm the grade distribution of the mineral resource outlined in the May 2019 independent technical report titled, “National Instrument 43-101 Technical Report Updated Mineral Resource Estimate for the South Mountain Project, Owyhee County, Idaho, USA.”, and to prepare for development of a National Instrument 43-101 Preliminary Economic Analysis. The South Mountain Project 43-101 Technical Report Updated Mineral Resource Estimate is available on the Company’s website at www.Thundermountaingold.com and on SEDAR at www.sedar.com.

From these recent analytical results, hole SM19-016 has identified multiple zones of anomalous gold and silver mineralization in the projected extension of the polymetallic DMEA zone (See Figure 1 & Table 2). The geological logging and interpretation of SM19-016 suggests this drill hole intersected the margins of the DMEA zone based on an increase in the observed ratio of skarn to massive sulfide styles of mineralization. The skarn occurrences at South Mountain are defined as hedenbergite (CaFe Si2O6) as the primary constituent of the skarn bodies with associated ilvaite, quartz and calcite, and locally with andraditic garnet occurrences. Future drilling will test areas in close proximity to SM19-016 where more massive sulfide mineralization is likely to be discovered. Drill holes SM19-017 and SM19-018 intersected intervals of predominantly high-grade zinc and silver mineralization associated with the MB4 target (See Figure 1 & Table 2). These holes represent the first drill testing at the MB4 target zone, generated from rib channel sampling results in the Sonneman level (See BeMetals press release dated June 18, 2019), and as such the orientation of this mineralization is not yet fully understood.

Eric T. Jones, President and CEO of Thunder Mountain Gold said of the 2019 phase 1 drill program, “We are extremely pleased with the results of the drill program and anticipate continued success in testing the upside potential of the mineralization in 2020.”

John Wilton, President, CEO and Director of BeMetals has previously announced that the results from the 2019 Phase 1 drilling exceeded their expectations and added that it reinforces BeMetal’s delivery of their goals for phase 1 drilling at South Mountain. Specifically, they were surprised and encouraged by drill hole SM19-014, demonstrating the potential to considerably expand the high-grade zinc and precious metal mineralization at this underground project. The multiple zones (six in total) of predominantly zinc, silver and gold in this hole, represent the deepest intersections of mineralization on the property. Importantly, this indicates that the DMEA zone of mineralization can be significantly extended at depth below the Sonneman underground level. This drill hole was terminated because the drill rig reached its maximum depth limitation.

In addition, the Company was pleased that BeMetal`s advisor, Dr. Richard Sillitoe, a well-known economic geologist from London U.K., spent several days on site examining underground exposures, drill core and surface outcrops. Dr. Sillitoe strongly endorsed the general exploration methodology being applied to the deposit. Importantly it was noted that the massive sulfides have mainly replaced the Laxey marble unit, implying that they may be considered as carbonate-replacement deposit (“CRD”) style of mineralization. This classification as a CRD by Dr. Sillitoe might well indicate that there is more upside to the ultimate scale of this deposit than was previously recognized.”

Table 1 below summarizes the drill intersections returned from the phase 1 program, demonstrating the high-grade nature of the base and precious metal mineralization. Figure 1 illustrates the compiled intersections which indicate the potential to significantly expand the mineral resource base at the South Mountain deposit following phase 2 drilling in 2020.

2019 PHASE 1 DRILLING AT THE SOUTH MOUNTAIN PROJECT

The principal objectives of the Phase 1 work plan at South Mountain was to test for potential extensions of the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource estimate. The Company has now successfully completed the phase 1 program comprised of 20 underground drill holes for a total of approximately 2,250 meters. Geological logging and sampling of all drill holes have now been completed with all analytical results received. These results have been compiled into the Project’s geological database and will be used to design the phase 2 drilling program for 2020. Following a planned phase 2 drilling program, all new results will be integrated into an updated mineral resource estimation for the Project, expected to be completed towards the end of this year. Further expansion and definition of the DMEA, Texas, and MB4 zones, as well as other targets within reach of underground drill testing from the Sonneman level, provide excellent exploration upside for the 2020 program.

* Note: 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.)

Table 2 below shows the latest results received from holes SM19-016, SM19-017 and SM19-018.

Note: Reported widths in tables 1 & 2 are drilled core lengths as true widths are unknown at this time. It is estimated based upon current data that true widths might range between 60-80% of the drilled intersection. For drill holes SM19-017* and SM19-018* true widths are unknown as these are the first drill intersections of the MD4 target. Intervals cut offs are based upon visual contacts of massive sulfide units with no more than 1.75 meters of internal skarn. For SM19-010 a nominal 0.5% copper cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 1.4m of internal dilution. For SM19-016† (intervals 1, 3 and 4) a nominal 0.46 g/t gold cut off has been applied to determine the boundaries of the intersections with no internal dilution. For SM19-017 & 018 a nominal 2.4% zinc cut off has been applied to determine the boundaries of the intersections for this skarn hosted mineralization with no more than 2m of internal dilution. (Note: See details below in QA/QC section). 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.)

The above drill holes returned significant intersections of both massive sulfide and skarn styles of mineralization. Important sulfide minerals are pyrrhotite, sphalerite, galena, arsenopyrite and chalcopyrite. During the planned phase 2 campaign at South Mountain, the Company will carry out mineralogy and metallurgical test work studies to confirm historical results.

From the recent batch of drilling, holes SM19-015, SM19-019, SM19-020 deviated from the target and did not return the anticipated drill intercepts. However, this information is valuable in determining to the design and target areas of mineralization in the 2020 phase 2 program. Drill hole SM19-021 had to be terminated at 10 meters with a significant drill rig break down near the planned conclusion of the phase 1 program.

Long Section of Sonneman Level, (Looking northeast), showing initial 14 borehole locations

BeMetals and Thunder Mountain Gold formed a project team that is focused on advancing South Mountain. This Boise Idaho-based team includes key management of Thunder Mountain Gold Inc., who have coordinated re-establishment of the Project site for the start of drilling. In addition, BeMetals appointed a project manager and project geologist for this team, along with technical and underground support. Since drilling commenced in July, there has been approximately 5,000 feet of core drilling, all of which has been logged, and prepared for assay. In addition, the team spent a considerable amount of resources re-establishing the electrical power system generated onsite and restarting the underground ventilation system.

During this exploration program at South Mountain, BeMetals plans to complete a total of about 20 holes with approximately 7,500 feet (2,300 metres) of diamond drilling. Fourteen borehole collars are currently planned and surveyed with a further six positions contingent upon field results of the initial holes. The Company will drill from the existing underground workings in the Sonneman Level as drilling from underground will provide more accurate and cost-effective drilling than from the surface. The drilling will be conducted, in general, as a series of fans from five drill platform locations within the existing Sonneman level. Two to five holes will be drilled from each platform in order to test the down plunge extension of the deposit below previously stoped areas. See Figures 1 and 2 below for the drill platform locations, the initially planned 14 boreholes, and targeted mineralized zones from the results of previous underground rib sampling of the Sonneman Level ribs at South Mountain.

South Mountain History

The limited historic production peaked during World War II when, based on smelter receipts, the production of direct shipped ore totaled 53,653 tons containing 3,118 ounces of gold, 566,439 ounces of silver, 13,932 pounds of copper, 2,562,318 pounds of lead and 15,593,061 pounds of zinc. In addition to the direct-ship ore, a flotation mill was constructed and operated during the late-1940s and early-1950s.

South Mountain Mines Inc. (an Idaho Corporation) owned the patented claims from 1975 to the time the Company purchased the entity in 2007. They conducted extensive exploration work including extending the Sonneman Level by approximately 1,500 feet to intercept the down-dip extension of the Texas sulfide mineralization mined on the Laxey Level approximately 400 feet up-dip from the Sonneman. High grade sulfide mineralization was intercepted and confirmed on the Sonneman Extension. In 1985 South Mountain Mines Inc. completed a feasibility study based on historic and newly developed ore zones exposed in their underground workings and drilling. This resulted in a historic resource of approximately 470,000 tons containing 23,500 ounces of gold, 3,530,000 ounces of silver, 8,339,000 pounds of copper, 13,157,000 pounds of lead and 91,817,000 pounds of zinc. Although they determined positive economics, and that the resource was still open at depth with a large upside potential, the project was shut down and placed into care and maintenance.

In 2008, the Company contracted Kleinfelder, Inc., a nationwide engineering and consulting firm, to complete a technical report “Resources Data Evaluation, South Mountain Property, South Mountain Mining District, Owyhee County, Idaho”. The technical report was commissioned by Thunder Mountain Resources, Inc. to evaluate all the existing data available on the South Mountain property. Kleinfelder utilized a panel modeling method using this data to determine potential mineralized material remaining and to make a comparison with the resource determined by South Mountain Mines in the mid-1980s. Kleinfelder’s calculations provided a potential resource that is consistent with South Mountain Mines’ (Bowes 1985) historic reserve model.

In 2009, the Company contracted a third-party consulting firm that incorporated all the new drill and sampling data into an NI 43-101 Technical Report. This report was completed as part of the Company’s dual listing on the TSX Venture Exchange in 2010.

Most Recent NI 43-101

In January of 2018, the Company engaged Hard Rock Consulting LLC (HRC) from Denver Colorado to update the South Mountain Project 43-101. HRC concluded that significant potential exists to increase the known mineral resource with additional drilling, as well as to upgrade existing mineral resource classifications with additional infill drilling. HRC also determined that the conceptual geologic model is sound, and, in conjunction with drilling results, indicates that mineralization is essentially open in all directions, and is continuous between underground levels and extends to the surface.

HRC also noted that:

- THMG technical staff has thorough understanding of the geology of the South Mountain Project, and that the appropriate deposit model is being applied for exploration.

- Because the Project is largely located on and surrounded by private land, it greatly simplifies Project approvals compared to mining projects involving public lands.

- Initial metallurgical testing demonstrates that the South Mountain massive sulfide/skarn mineralization is amenable to differential flotation and concentration.

- The current mineral resource at the South Mountain Project more than sufficient to warrant continued planning and development to further advance the Project.

The Technical Report was authored by Ms. J.J. Brown, P.G., SME-RM, Mr. Jeffrey Choquette, P.E., and Mr. Randy Martin, SME-RM, all of Hard Rock Consulting, each of whom is an independent qualified person for the purposes of NI 43-101 The NI 43-101 Technical Report has an effective date of April 7, 2018 and has been filed in Canada on SEDAR in accordance with NI 43-101. The Report can be reviewed on the Company`s website at www.thundermountaingold.com.

Note to United States investors concerning estimates of measured, indicated and inferred resources. Disclosure of the NI-43-101 has been prepared in accordance with the requirements of Canadian securities laws, including Canadian National Instrument 43-101 (“NI 43-101”), which differ from the current requirements of the U.S. Securities and Exchange Commission (“SEC”) set out in Industry Guide 7. The Highlights of South Mountain NI-43-101 section refers to “mineral resources,” “measured mineral resources,” “indicated mineral resources,” and “inferred mineral resources.” While these categories of mineralization are recognized and required by Canadian securities laws, they are not recognized by Industry Guide 7 and are not normally permitted to be disclosed in SEC filings. United States investors are cautioned not to assume that all or any of measured, indicated or inferred mineral resources will ever be converted into mineral reserves. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the mineralization can be economically or legally extracted at the time the “reserve” determination is made. “Inferred mineral resources” have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian reporting standards; however, Industry Guide 7 normally only permits issuers to report mineralization that does not constitute “reserves” by Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Accordingly, information contained in this 10-k containing descriptions of South Mountain’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of Industry Guide 7.

Highlights of South Mountain Mine NI-43-101 Report:

The most recent THMG drilling program was successful in defining the geometry and confirming the grades of the DMEA and Texas massive sulfide zones. Confirmed intercepts within the model include:

- DMEA core hole DM2UC13-13, returned a 91.5-foot true width intercept of 13.79% Zn, 12.75 o.p.t. Ag, 0.08 o.p.t. Au, 0.45% Cu, and 7.07% Pb;

- Texas core hole TX13-03 drilled from the surface across the zone, returned 11.8 feet true width, assaying 14.08% Zn, 9.01 o.p.t. Ag, 0.01 o.p.t. Au, 1.43% Cu, and 0.35% Pb

- DMEA core hole DM2UC13-17, includes a 42-foot true width intercept of 17.86% Zn, 2.98 o.p.t. Ag, 0.13 o.p.t. Au, 0.18% Cu, and 0.47% Pb;

- Rib channel samples across the DMEA zone on the Sonneman of 130 feet true width, assaying 16.76% Zn, 4.11 o.p.t Ag, 0.09 o.p.t. Au, 0.78% Cu, and 0.38% Pb (pg.38 of the report), including 60 feet true width intercept assaying 25.00% Zn, 3.80 o.p.t Ag, 0.130 o.p.t. Au, 0.38% Cu, and 0.41% Pb

Details of the Technical Report:

The Table below outlines the Mineral Resource Statement for the South Mountain Project as of April 7, 2018.

Underground core drilling is being conducted to extend and upgrade the South Mountain resource – testing the continuity and down-dip extensions of the high-grade polymetallic massive sulfide zones. The Company plans additional core drilling in the DMEA and Laxey zones to complete the confirmation and extensional drilling. In addition, there are plans to retrieve bulk samples for metallurgical test work. More than 15,000 feet (4,500 meters) have been drilled at South Mountain and included in the model. The South Mountain historic ore zones remain open down-dip on the zones encountered. The successful drilling and development work prove that the South Mountain resource continues to grow with potential to increase the resource substantially.

HRC also reviewed the data on the anomalous gold-bearing multi-lithic breccia that was identified by THMG conducting reconnaissance work at South Mountain. In 2010, five holes were drilled in the anomaly for a total footage of 3,530 feet, and 705 total samples taken every five feet of drill hole. Of the 705 samples taken, 686 samples contained anomalous gold, or 97% of the samples. The highest-grade intercept ran 0.038 ounce per ton. HRC reviewed the reports done on the breccia completed by both Kinross and Newmont; of note was Newmont’s comparison of the geology to the Battle Mountain Complex in Nevada.

QUALITY ASSURANCE AND QUALITY CONTROL PROCEDURES

The Project employs a rigorous QC/QA program that includes; blanks, duplicates and appropriate certified standard reference material. All samples are introduced into the sample stream prior to sample handling/crushing to monitor analytical accuracy and precision. The insertion rate for the combined QA/QC samples is 10 percent or more depending upon batch sizes. ALS Global completed the analytical work with the core samples processed at their preparation facility in Reno, Nevada, U.S.A. All analytical and assay procedures are conducted in the ALS facility in North Vancouver, BC. The samples are processed by the following methods as appropriate to determine the grades; Au-AA23-Au 30g fire assay with AA finish, ME-ICP61-33 element four acid digest with ICP-AES finish, ME-OG62-ore grade elements, four acid with ICP-AES finish, Pb-OG62-ore grade Pb, four acid with ICP-AES finish, Zn-OG62-ore grade Zn, four acid digest with ICP-AES finish, Ag-GRA21-Ag 30g fire assay with gravimetric finish.

Figure 1: 3D Perspective View inclined at 20 degrees looking north-north-east, showing locations of rib-sampling, priority target zones, and the phase 1 drill holes and highlighted the recent SM19-016, SM19-017 and SM19-018

Figure 2: Plan View of the Sonneman & Laxey Levels, South Mountain Deposit, showing locations of rib-sampling, priority target zones, and drill holes SM19-016, SM19-017 and SM19-018

Figure 3: Plan View of Sonneman & Laxey Levels, showing locations of previously reported rib sampling

Highlights from 2013-2014 Rib-Sampling Program

- DMEA Zones 1/2/3; 130 ft. (39.62m) @ 16.76% Zinc (“Zn”), 4.11 ounces per ton (“o.p.t.”) (140.91 grams per tonne (“g/t”)) Silver (“Ag”), 0.089 o.p.t. (3.08 g/t Gold) (“Au”), 0.78% Copper (“Cu”) and 0.38% Lead (“Pb”)

- Muck Bay #4 Zone; 23 ft. (7.01m) @ 14.69% Zn, 7.18 o.p.t. (246.17 g/t) Ag, 0.34% Cu and 0.65% Pb

- Laxey Zone; 40 ft. (12.19m) @ 16.44% Zn, 13.97 o.p.t. (478.97 g/t) Ag, 0.020 o.p.t. (0.68 g/t) Au, 0.70% Cu and 0.86% Pb

(Results previously reported in the Company`s annual / quarterly reports; news releases; and the May 2019 independent technical report titled, “National Instrument 43-101 Technical Report Updated Mineral Resource Estimate for the South Mountain Project Owyhee County, Idaho, USA.” 1.00 meter (m) is equal to 3.28 feet (ft). One gram per tonne (g/t) is equal to 0.032 ounces per ton (oz/t, or o.p.t.))

The Technical information in this project summary has been reviewed and approved by Larry D. Kornze, P. Eng., Qualified Person, and Director of Thunder Mountain Gold Inc., and a “Qualified Person” as defined by National Instrument 43-101 standards.

BeMetals Corp.

BeMetals’ founding Directors include Clive Johnson, Roger Richer, Tom Garagan and John Wilton. BeMetals is a new base metals exploration and development company focused on becoming a significant base metal producer through the acquisition of quality exploration, development and potentially production stage base metals projects. The Company is advancing both its early stage, tier one targeted, Pangeni Copper Exploration Project in Zambia, and its advanced high-grade, zinc-silver polymetallic underground exploration at the South Mountain Project in Idaho, USA. The Company’s growth strategy is led by our strong Board, key members of which have an extensive proven record of delivering considerable value in the mining sector through the discovery, construction and operation of mines around the world. The Board, its Advisors, and senior management also provide outstanding deal flow of projects to BeMetals based upon their extensive network of contacts in the international minerals business.