Hard Rock Consulting, LLC (“HRC”) of Lakewood, Colorado completed the Technical Report for the Company`s South Mountain Project (the “Project”). HRC is an independent consulting practice comprised of a formal collaboration of mining industry professionals, including geologists, engineers, and business advisors, who offer an experience base of international professionals. HRC provides services ranging from grass-roots exploration through project feasibility, development, and mine closure. HRC is independent of the Company within the meaning of NI 43-101. More information on HRC can be found at www.hardrock-consulting.com.

- HRC concludes that significant potential exists to increase the known mineral resource with additional drilling, as well as to upgrade existing mineral resource classifications with additional infill drilling.

- HRC also finds that the conceptual geologic model is sound, and, in conjunction with drilling results, indicates that mineralization is essentially open in all directions, and is continuous between underground levels and extends to the surface.

Highlights of the Technical Report:

- The most recent THMG drilling program was successful in defining the geometry and confirming the grades of the DMEA and Texas massive sulfide zones. Confirmed intercepts within the model include:

- DMEA core hole DM2UC13-13, returned a 91.5-foot true width intercept of 13.79% Zn, 12.75 o.p.t. Ag, 0.08 o.p.t. Au, 0.45% Cu, and 7.07% Pb;

- Texas core hole TX13-03 drilled from the surface across the zone, returned 11.8 feet true width, assaying 14.08% Zn, 9.01 o.p.t. Ag, 0.01 o.p.t. Au, 1.43% Cu, and 0.35% Pb

- DMEA core hole DM2UC13-17, includes a 42-foot true width intercept of 17.86% Zn, 2.98 o.p.t. Ag, 0.13 o.p.t. Au, 0.18% Cu, and 0.47% Pb;

- Rib channel samples across the DMEA zone on the Sonneman of 130 feet true width, assaying 16.76% Zn, 4.11 o.p.t Ag, 0.09 o.p.t. Au, 0.78% Cu, and 0.38% Pb (pg.38 of the report), including 60 feet true width intercept assaying 25.00% Zn, 3.80 o.p.t Ag, 0.130 o.p.t. Au, 0.38% Cu, and 0.41% Pb

Eric Jones, President and CEO of THMG commented “We are pleased to have completed this important update of the South Mountain Technical Report. The report confirms the high-grade nature of the deposit, updates the resource estimate and sets forth the tremendous resource expansion potential of the project. We believe this report will provide the foundation for the Company to pursue the further development potential of the project and allow us to begin evaluating financing options, including potential strategic alliances with other mining companies or investors.”

Details of the Technical Report:

The Table below outlines the Mineral Resource Statement for the South Mountain Project as of April 7, 2018.

| Mineral Resources at 6.04% ZnEq Cut-off |

|

Classification

|

Zinc Equivalent Resource

|

Contained Metal |

| Short Tons |

ZnEq lbs |

ZnEq % |

Zn lbs |

Zn% |

Ag oz |

Ag opt |

Au oz |

Au opt |

Pb lbs |

Pb % |

Cu lbs |

Cu % |

| x1000 |

x1000 |

x1000 |

x1000 |

x1000 |

x1000 |

x1000

|

| Measured |

63.2 |

22,200 |

17.57 |

14,700 |

11.64 |

237 |

3.745 |

4.0 |

0.063 |

600 |

0.483 |

700 |

0.566 |

| Indicated |

106.7 |

37,800 |

17.72 |

21,500 |

10.08 |

576 |

5.398 |

7.0 |

0.066 |

2,100 |

0.983 |

1,600 |

0.766 |

| Measured + Indicated |

169.9 |

60,000 |

17.66 |

36,200 |

10.66 |

813 |

4.783 |

11.0 |

0.065 |

2,700 |

0.797 |

2,300 |

0.692 |

| Inferred massive sulfide |

363.2 |

120,800 |

16.63 |

70,500 |

9.70 |

2,029 |

5.585 |

16.3 |

0.045 |

8,700 |

1.202 |

5,200 |

0.696

|

Notes:

- The effective date of the mineral resource estimate is April 7th, 2018. The QP for the estimate is Mr. Randall K. Martin, of Hard Rock Consulting, LLC. and is independent of THMG.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are that part of the mineral resource for which quantity and grade or quality are estimated on the basis of limited geologic evidence and sampling, which is sufficient to imply but not verify grade or quality continuity. Inferred mineral resources may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

- The mineral resource is reported at an underground mining cutoff of 6.04% Zinc Equivalent Grade (“ZnEq”) within coherent wireframe models. The ZnEq calculation and cutoff is based on the following assumptions: an Au price of $1,231/oz, Ag price of $16.62/oz, Pb price of $0.93/lb., Zn price of $1.10/lb. and Cu price of $2.54/lb.; metallurgical recoveries of 75% for Au, 70% for Ag, 87% for Pb, 96% for Zn and 56% for Cu, assumed mining cost of $70/ton, process costs of $25/ton, general and administrative costs of $7.5/ton, smelting and refining costs of $25/ton. Based on the stated prices and recoveries the ZnEq formula is calculated as follows; ZnEq = (Au grade * 43.71) + (Ag grade * 0.55) + (Pb grade * 0.77) + (Cu grade * 1.35) + (Zn grade)

- Rounding may result in apparent differences when summing tons, grade and contained metal content. Tonnage and grade measurements are in imperial units.

The updated resource model does not include any of the remaining polymetallic massive sulfide left in the upper part of the Laxey zone. Available historic smelter records indicate that approximately 53,642 tons of polymetallic massive sulfide were mined and direct shipped, mostly from this Zone. Historical smelter records indicate zinc values averaging 14.5%, lead 2.4%, copper 1.4%, silver at 10.6 opt, and gold at 0.058 opt (Table 6-2 of the Technical Report).

HRC noted in the Technical Report the following findings:

- That THMG has thorough understanding of the geology of the South Mountain Project, and that the appropriate deposit model is being applied for exploration.

- That the Project is largely located on and surrounded by private land, which greatly simplifies Project approvals compared to public lands.

- That initial metallurgical testing demonstrates that the South Mountain massive sulfide/skarn mineralization is amenable to differential flotation and concentrated.

- That the current mineral resource at the South Mountain Project more than sufficient to warrant continued planning and development to further advance the Project.

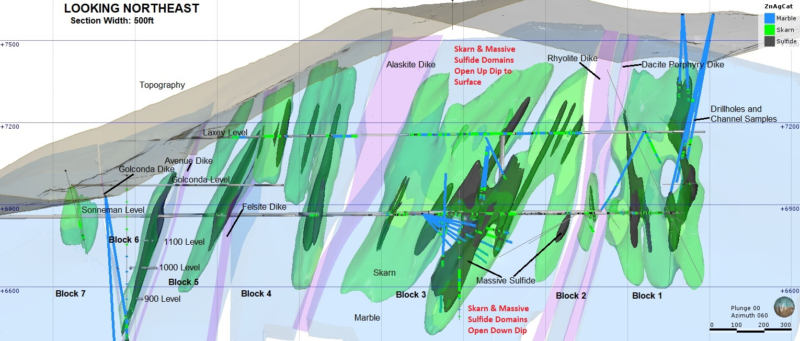

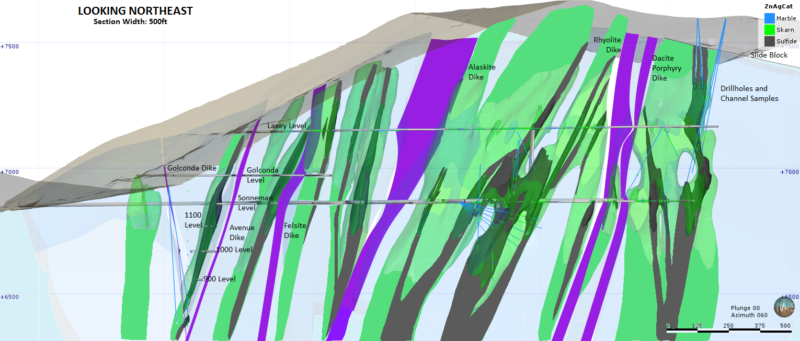

Long Section View of Modeled Estimation Domains. The deposit remains open along strike and down dip in the Laxey marble as shown in Figure 7-4 of the updated NI 43-101 Report.

Long Section View of Modeled Estimation Domains. The deposit remains open along strike and down dip in the Laxey marble as shown in Figure 7-4 of the updated NI 43-101 Report.

Schematic Long Section of South Mountain Skarn Deposits

Underground Pre-Development Work Completed Since Last South Mountain Project NI-43-101

The reconstruction of the Sonneman and Laxey drifts continued successfully until January 2014 when the Project went into care and maintenance. The Sonneman Level advanced 2,711 feet from the portal and is constructed to 12 feet by 12 feet for future development and mining. Approximately 350 feet of drift remains to be rehabilitated to reach the historic Texas massive sulfide zone located at the end of the old workings. This advance through this zone will allow for the drill stations and underground drilling to further define the high-grade resource encountered by William Bowes group in the 1980s.

The historic 2,200-foot long Laxey Level drift has been rehabilitated to 10 feet by 10 feet for approximately 720 feet. At that point the old tunnel had recently collapsed at an intrusive dike and preparations were being made to advance through the caved area. This old tunnel was rehabilitated and accessed along its full length in 2008, at which point it intercepted the Texas massive sulfide zone, one of many that had limited mining during and after the World War II period. Excellent high grade massive sulfide is exposed in this area, and the core drilling during 2013 proved its continuity between the Laxey Level and the surface, an up-dip distance of nearly 400 feet.

During the development of the Sonneman Level during 2012-2013 several massive sulfide mineralized zones were mined through. Detailed rib sampling along some of these zones yielded the following results:

Significant THMG Channel Sample Intervals– Sonneman Drift

| ID |

From |

To |

Length |

Ag (opt) |

Zn % |

Au (opt) |

Cu % |

Pb % |

| OGT161671-02 |

30.0 |

160.0 |

130.00 |

4.11 |

16.76 |

0.09 |

0.78 |

0.38 |

| OGT161671-02 |

209.2 |

230.2 |

21.00 |

3.14 |

14.02 |

0.26 |

0.31 |

0.37 |

| OGT161671-02 |

270.2 |

275.0 |

4.80 |

3.21 |

13.80 |

0.24 |

0.14 |

1.10 |

| OGT161714-22 |

9.0 |

32.0 |

23.00 |

7.18 |

14.69 |

0.01 |

1.17 |

0.65 |

| OGT161714-22 |

76.9 |

92.0 |

15.10 |

8.24 |

14.04 |

0.01 |

2.30 |

0.59 |

| OGT161735-9 |

0.0 |

40.0 |

40.00 |

13.97 |

16.44 |

0.02 |

0.70 |

0.86 |

| OGT161724-30 |

0.0 |

40.0 |

40.00 |

5.80 |

5.63 |

0.00 |

0.28 |

2.83 |

HRC also reviewed the data on the anomalous gold-bearing multilithic breccia that was identified by THMG conducting reconnaissance work at South Mountain. In 2010, five holes were drilled in the anomaly for a total footage of 3,530 feet, and 705 total samples taken every five feet of drill hole. Of the 705 samples taken, 686 samples contained anomalous gold, or 97% of the samples. The highest-grade intercept ran 0.038 ounce per ton. HRC reviewed the reports done on the breccia completed by both Kinross and Newmont; of note was Newmont’s comparison of the geology to the Battle Mountain Complex in Nevada.

Recommended Work Plan and Budget

The Technical Report included a work program recommended by HRC that is intended to support advancing the Project to the next level of study, whether a preliminary economic assessment or prefeasibility study. HRC concluded that engineering aspects of Project development need to be assessed in order to identify and evaluate any potentially associated difficulties or costs that might impact the overall Project economics. The recommended work plan is heavily weighted toward underground drilling. The underground workings will require some rehabilitation work and establishment of drilling bays, which will account for a major portion of the total estimated cost. The Company’s goal is approximately 50% confirmation and in-fill drilling, with the balance geared toward down dip extensions of the major massive sulfide zones. A summary of the recommended Scope of Work is as follows:

| Recommended Scope of Work |

Expected Cost (US$) |

| Underground rehab and exploration drift |

$1,470,000 |

| Definition Drilling |

$1,450,000 |

| Data organization, resource modeling and PEA 43-101 |

$300,000 |

| Metallurgical Testing |

$255,000 |

| Admin oversite / Environmental / Health and Safety |

$1,047,000 |

| Contingency |

$450,000 |

| Total Budget |

$4,972,000 |

Qualified Persons under NI 43-101

The Technical Report was authored by Ms. J.J. Brown, P.G., SME-RM, Mr. Jeffrey Choquette, P.E., and Mr. Randy Martin, SME-RM, all of Hard Rock Consulting, each of whom is an independent qualified person for the purposes of NI 43-101 and has read and approved the respective scientific and technical disclosure contained in this press release. Edward D. Fields, P.G., technical advisor to the board of the Company, is the qualified person within the meaning of National Instrument 43-101 who has reviewed and approved the technical data reported in this news release.

Data Verification

Detailed descriptions of the Company’s exploration drilling, sampling and analytical procedures, and data verification procedures carried out by HRC are included in the Technical Report.

Regarding Thunder Mountain Gold, Inc.

Thunder Mountain Gold Inc., a junior exploration company founded in 1935, owns interests in base and precious metals projects in the western U.S. The Company’s principal asset is The South Mountain Mine, an historic former producer of zinc, silver, gold, lead, and copper, located on private land in southern Idaho, just north of the Nevada border. The Company also owns 100% of the Trout Creek Project – a grass roots gold target in the Eureka-Battle Mountain trend of central Nevada. For more information on Thunder Mountain, please visit the Company’s website at www.Thundermountaingold.com.

Forward-Looking Statements

This press release contains forward-looking statements that are based on the beliefs of management and reflect the Company’s current expectations. The forward-looking statements in this press release include statements with respect to the terms and use of proceeds of the Private Placement, the ability of the Company to complete the Private Placement and the impact of the Private Placement on the Company. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. The forward-looking statements are based on certain assumptions, which could change materially in the future, including the assumption that the Private Placement will be completed. By their nature, forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include the risk of completion of the Private Placement and uncertainties affecting the expected use of proceeds. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking information. Forward-looking information is provided as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required in accordance with applicable laws.

Cautionary note to United States investors concerning estimates of measured, indicated and inferred resources.

This news release contains certain disclosure that has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all reserve and resource estimates included in this news release have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) classification system. The estimated mineral resource for the Project is based on drillhole and channel sampling data constrained by geologic boundaries with an Ordinary Kriging (“OK”) algorithm. MicroModel® 9.0 (“MicroModel”) software was used to complete the resource estimate. Canadian standards, including NI 43-101, differ significantly from the requirements of U.S. securities laws, and reserve and resource information contained in this news release may not be comparable to similar information disclosed by companies reporting only under U.S. standards. In particular, the term “resource” does not equate to the term “reserve” under SEC Industry Guide 7. United States investors are cautioned not to assume that all or any of Measured or Indicated Mineral Resources will ever be converted into mineral reserves. Investors are cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists or is economically or legally minable.

Cautionary Note to Investors

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Thunder Mountain Gold, Inc.

Eric T. Jones Jim Collord

President and Chief Executive Officer Vice President and Chief Operating Officer

eric@thundermountaingold.com jim@thundermountaingold.com

Tel: (208) 658-1037 Tel: (208) 658-1037